As of EP284, November 2023

FIX Global Technical Committee

Table of Contents

Preface

The Financial Information eXchange (FIX®) Protocol effort was initiated in 1992 by a group of institutions and brokers interested in streamlining their trading processes. These firms felt that they, and the industry as a whole, could benefit from efficiencies derived through the electronic communication of indications, orders and executions. The result is FIX, an open message standard controlled by no single entity, that can be structured to match the business requirements of each firm. The benefits are:

- From the business flow perspective, FIX provides institutions, brokers, and other market participants a means of reducing the clutter of unnecessary telephone calls and scraps of paper, and facilitates targeting high quality information to specific individuals.

- For technologists, FIX provides an open standard that leverages the development effort so that they can efficiently create links with a wide range of counterparties.

- For vendors, FIX provides ready access to the industry, with the incumbent reduction in marketing effort and increase in potential client base.

Openness has been the key to FIX’s success. For that reason, while encouraging vendors to participate with the standard, FIX has remained vendor neutral. Similarly, FIX avoids over-standardization. It does not demand a single type of carrier (e.g., it will work with leased lines, frame relay, Internet, etc.), nor a single security protocol. It leaves many of these decisions to the individual firms that are using it. We do expect that, over time, the rules of engagement in these non-standardized areas will converge as technologies mature.

FIX is now used by a variety of firms and vendors. It has clearly emerged as the inter-firm messaging protocol of choice. FIX has grown from its original buy-side to sell-side equity trading roots. It is now used by markets (exchanges, “ECNs”, etc) and other market participants. In addition to equities, FIX currently supports four other products: Collective Investment Vehicles (CIVs), Derivatives, Fixed Income, and Foreign Exchange. The process for modifications to the specification is very open with input and feedback encouraged from the community. Those interested in providing input to the protocol are encouraged use the FIX website Discussion section or contact the FIX Global Technical Committee (GTC) Chairpersons). The FIX website is the main source of information, discussion, and notification of FIX-related events.

We look forward to your participation.

About FIX Protocol Limited

FIX Protocol Limited (FPL) oversees and manages the development of the FIX Protocol specification and encourages its use throughout the industry. FPL is open to due paying members representing business and technology professionals interested in guiding the growth and adoption of the FIX Protocol that work for: Buy-Side Firms, Sell-Side Firms, Exchanges, ECNs/ATSs, Utilities, Vendors, and Other Associations. For more information about membership please visit https://www.fixtrading.org.

FIX Trading Community™ is a brand of FIX Protocol Ltd, a non-profit UK registered entity, originally created to own, maintain and develop the FIX Protocol messaging language.

FIX® is embedded into the fabric of the financial trading community, used by thousands of firms every day to complete millions of transactions in a cost-efficient and effective manner.

FIX has been created and continues to be developed through collaborative industry efforts with the intention that it remains as a non-proprietary, free and open protocol. Maintaining this position is of utmost importance, as the cost to the industry of a fee based alternative would prove incredibly expensive.

To ensure this status is protected, FIX Protocol Ltd is managed under a special “Purpose Trust” which owns the assets and enables the organisation to concentrate on promoting protocol adoption without undue risk or exposure. An effort that is further supported by legal protection afforded through the fees paid by member firms.

FIX Protocol Limited is represented by the following high-level organization:

- Global Steering Committee comprised of the FPL Global Committee Chairs

- Global Technical Committee comprised of Product/Region Committee Representatives

- Global Product Committees (Fixed Income & Currencies, Listed Products & Exchanges)

- Global Buy-Side Committee

- Global Member Services Committee

- Regional Committees (Americas, Asia Pacific, EMEA, Japan)

For a current list of FPL Member firms, visit https://www.fixtrading.org/member-firms/.

For a current list of active FPL Working Groups, visit https://www.fixtrading.org/working-groups/.

Links to Product and Regional Committees’ web pages are at https://www.fixtrading.org/committees/.

Introduction

The Financial Information Exchange (FIX®) Protocol is a message standard developed to facilitate the electronic exchange of information related to securities transactions. It is intended for use between trading partners wishing to automate communications.

The message protocol, as defined, will support a variety of business functions. FIX was originally defined for use in supporting US domestic equity trading with message traffic flowing directly between principals. As the protocol evolved, a number of fields were added to support cross-border trading, derivatives, fixed income, and other products. Similarly, the protocol was expanded to allow third parties to participate in the delivery of messages between trading partners. As subsequent versions of FIX are released, it is expected that functionality will continue to expand.

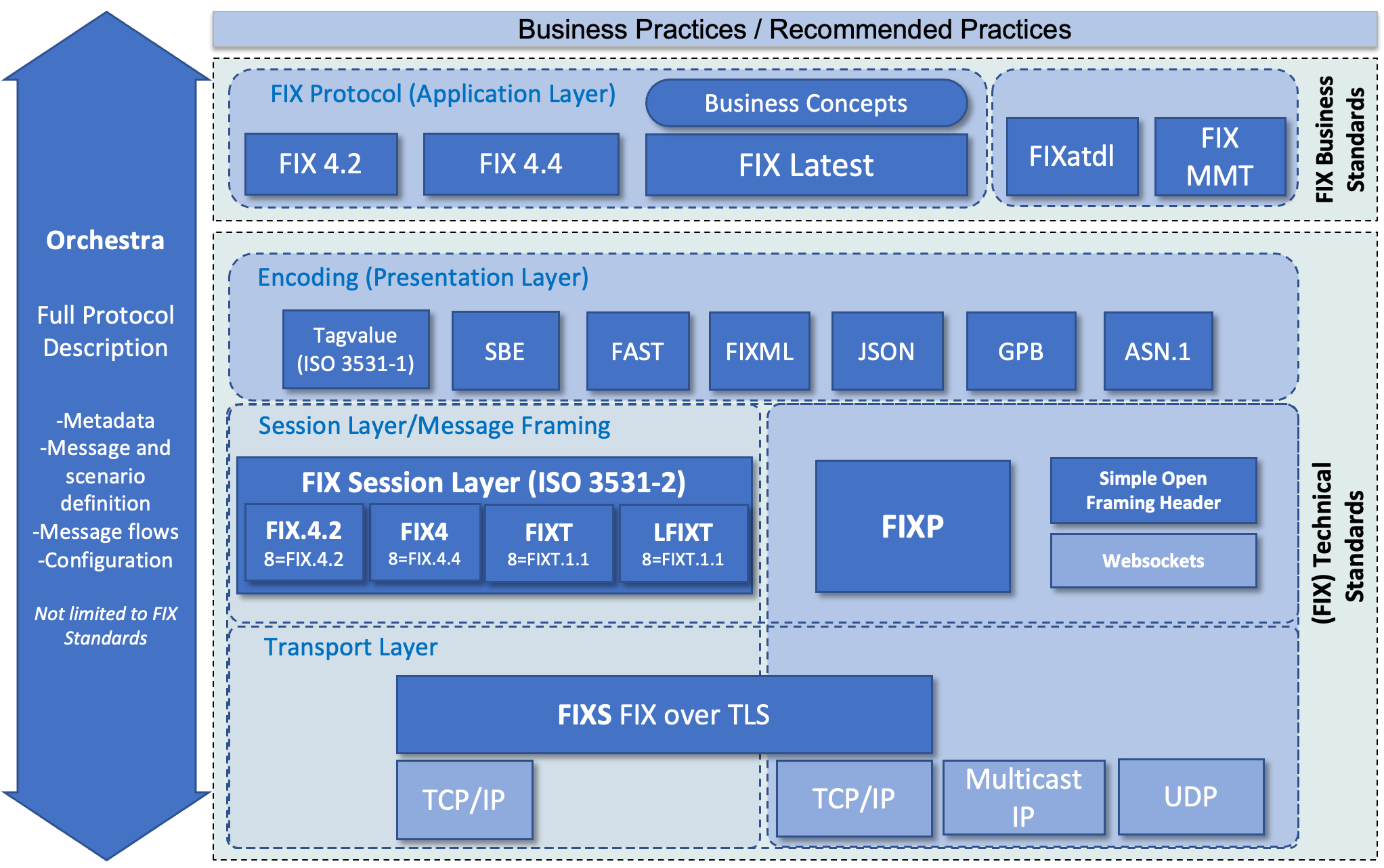

The FIX Family of Standards addresses the different needs of the application, encoding and session level. Whilst there is basically a single standard called FIX Latest for the application level defining business related data content, FIX offers a number of choices for the encoding of messages as well as for the session level, i.e. the technical interaction between counterparties to deliver data. There is a second standard for the application level called FIXatdl which is an XML based standard to specify the user interface components for algorithmic trading.

Specifications for the encoding (a.k.a. “syntax”) and the session level are called Technical Standards and have their own name and version together with their own documentation. FIX also supports industry standards such as Google Protocol Buffers (GPB) for encoding and Advanced Message Queuing Protocol (AMQP) for the session protocol. This document is only about FIX Latest, i.e. the application level.

The following table shows a comprehensive list of the FIX Family of Standards followed by a diagram of the FIX Technical Standard Stack:

| Standard | Acronym | Layer | Description |

|---|---|---|---|

| FIX Protocol (a.k.a. FIX Latest) | FIXLatest | Application | The most current version of FIX that supports multiple asset classes and a wide range of trading life cycle business processes. It includes all FIX Extension Packs. |

| FIX Algorithmic Trading Definition Language | FIXatdl | Application | XML based standard to specify the user interface components for algorithmic trading. |

| FIX tag=value | tagvalue | Encoding | Original FIX encoding and the most widely used one. A simple ASCII string format. |

| FIX Markup Language | FIXML | Encoding | XML encoding used within FIX. FIXML is widely adopted for derivatives post trade clearing and settlement globally. FIXML is also used for reporting. |

| FIX Adapted for STreaming | FAST | Encoding | Protocol designed to reduce bandwidth use and latency for market data dissemination. |

| Simple Binary Encoding | SBE | Encoding | High performance binary encoding in use within the industry for market data dissemination as well as for transactional workflows. |

| Encoding FIX using Google Protocol Buffers | GPB | Encoding | FIX encoding using industry standard protocol GPB. Often used within companies as part of internal messaging. |

| Encoding FIX using Javascript Object Notation | JSON | Encoding | FIX encoding using industry standard protocol JSON. Intended for both internal processing and the use of FIX application messages within web based applications and APIs. |

| Encoding FIX using Abstract Syntax Notation | ASN.1 | Encoding | FIX encoding using industry standard protocol ASN.1. ISO standard encoding system that includes multiple encodings itself (BER, OER, PER, XER). |

| FIX Session Protocol | FIX.4.2 | Session | FIX session protocol with FIX.4.2 session profile for application version FIX 4.2. |

| FIX Session Protocol | FIX4 | Session | FIX session protocol with FIX4 session profile for application version FIX 4.4. |

| FIX Session Protocol (a.k.a. “FIX Transport”) | FIXT | Session | FIX session protocol with FIXT session profile for multiple application versions. Application version independent session protocol introduced with FIX 5.0. |

| FIX Session Protocol (a.k.a. “Lightweight FIXT”) | LFIXT | Session | FIX session protocol with FIXT session profile for single application version. It is a restriction of the FIXT session profile. |

| FIX Performance Session Protocol | FIXP | Session | High performance session protocol for point-to-point and multicast that supports multiple modes of operation (recoverable, unsequenced, idempotent). |

| FIX Simple Open Framing Header | SOFH | Session | Simple and primitive message framing header that communicates two pieces of information, the length of a message and the encoding type of that message. |

| FIX-over-TLS | FIXS | Session | Standard to secure FIX sessions using the industry standard Transport Layer Security (TLS) protocol. |

Organization of specification

The FIX Latest Specification is organized into multiple areas (a.k.a. “sections”), with each area covering specific categories followed by an appendix with detailed component and message layouts. The titles for areas other than the introduction are directly linked to the appropriate websites as part of the FIX Online Specification.

- Introduction to FIX

- FIX Application Messages for Pre-trade

- FIX Application Messages for Orders and Executions (Trade)

- FIX Application Messages for Post-trade

- CATEGORY: ALLOCATION AND READY-TO-BOOK

- CATEGORY: CONFIRMATION

- CATEGORY: SETTLEMENT INSTRUCTIONS

- CATEGORY: TRADE CAPTURE (“STREETSIDE”) REPORTING

- CATEGORY: REGISTRATION INSTRUCTIONS

- CATEGORY: POSITIONS MAINTENANCE

- CATEGORY: COLLATERAL MANAGEMENT

- CATEGORY: MARGIN REQUIREMENT MANAGEMENT

- CATEGORY: ACCOUNT REPORTING

- CATEGORY: TRADE MANAGEMENT

- CATEGORY: PAY MANAGEMENT

- CATEGORY: SETTLEMENT STATUS MANAGEMENT

- APPENDIX: COMPONENTS AND MESSAGES

- FIX Application Messages for Infrastructure

Message and Component Definitions

All areas contain definitions of FIX components and application messages. Components are sets of related data fields grouped together and are referenced by the component name in messages that they are used in. FIX components are organized as follows:

- Global Components – are components commonly used by many messages defined across all areas of the FIX specification. These are the most commonly used components. Their definitions are found here.

- Common Components – are section-specific components, i.e. these are components commonly used only by the FIX messages found in that area or section (e.g. pre-trade, trade, post-trade sections). Their definitions are found at the end of the appendix of the area-specific documentation.

- Specific Components – are message category specific components, i.e. these are components that are used only by the FIX messages in a specific message category in a given area (e.g. Securities Reference Data message category). Their definitions are found in the appendix of the area-specific documentation in their respective message category.

- Messages are described as part of the category description. Additionally, the detailed message layouts are found in the appendix of the area-specific documentation in their respective message category.

- Messages are comprised of required, optional and conditionally required (fields which are required based on the presence or value of other fields) fields. Systems should be designed to operate when only the required and conditionally required fields are present.

- Messages and components may have nested fields and components as part of repeating groups. The tag number (name) of a nested field (component) is prefixed with an arrow “→”.

Extension Pack Management

Extension Packs are the building blocks of FIX Latest and represent specific functional proposals that have been presented to and approved by the GTC. Extension Packs are applied to the repository in a cumulative manner, i.e. the latest Extension Pack always includes all previous Extension Packs. Extension Packs management will be conducted as follows:

- Extension Packs will be assigned a unique, sequential number at the point they are approved by the GTC.

- Extension Packs are applied to the most recent version of the repository and may be inclusive of prior Extension Packs.

- At the point an Extension Pack has been applied, the updated repository, schema, and message tables will be publicly available.

- When implementing a specific Extension Pack, ApplExtID(1156) may be used to specify the Extension Pack identifier, i.e. its number.

- Users of an Extension Pack do not need to implement it in its entirety and do not need to implement other Extension Packs present in the repository. Rules of engagement need to be bilaterally agreed on to define the supported subset of FIX Latest.

List of Extension Packs

The following list contains all extension packs published after the release of FIX Version 5.0 Service Pack 2. The “size” information is intended to give an orientation as to the impact of an EP. This is primarily driven by the amount of new messages, fields and values but may also be due to business relevance.

| EP | Title | Size | Enhancement Summary |

|---|---|---|---|

| EP098 | FillsGrp Yield Extension | XS | Yield information for partial fills conveyed with the FillsGrp component. |

| EP099 | Matching Instructions | S | New component to convey one or more instructions to allow or deny matching based on tags and values. |

| EP100 | FX Spot and Forward Swaps Matching | M | Additional types of contingency orders, triggering instructions, price types for FX, duration of order exposure. New component to convey various types of limit amounts, e.g. credit limits. |

| EP101 | Canadian Market Regulation Feed | M | Additional types of cross orders, order categories, execution instructions, restatement reasons, account types, regulatory timestamps, instrument attributes, trade types. |

| EP102 | Margin Requirements | L | New messages to convey margin requirements and related inquiries. |

| EP103 | Large Options Positions Reporting | M | New repeating group RelatedInstrumentGrp to convey one or more securities related to the main instrument of the message, e.g. a hedging instrument. Support for covered short quantities, additional position types, additional party roles, party address information, (foreign) tax ID as new source for party identifiers. |

| EP104 | IIROC Market Regulation Feed | M | Support for market maker participation in a security, identification of opening trades, unsolicited order cancellations due to a trade price violation or due to a cross imbalance. |

| EP105 | Parties Reference Data | XXL | New messages and components to support the request for and the distribution of reference data for parties, accounts and risk limits. Addition of qualifiers for party roles to add more granularities to selected roles. Inline component reference enhancement for the FIXML Technical Standard. |

| EP106 | Market Data Extensions | L | New messages to support mass status information for securities, specifically options. Additional market data entry types for market order quantities (bid and offer). |

| EP107 | OTC Trading and Clearing Extensions | M | Set of extensions to support OTC trading and clearing with a focus on the processes used in trade submission, clearing and valuation of OTC and off-exchange trades. New repeating group SecurityClassificationGrp to support classification of products. |

| EP108 | New PartyIDSource values for Australia | XXS | Australian Company Number and Australian Registered Body Number. |

| EP109 | Contingent Price | XXS | Risk adjusted price used to calculate variation margin on a position. |

| EP110 | Long Holdings | XXS | Long holdings as additional type of position transaction |

| EP111 | Submission of SLEDS | XS | Alternate price for clearing if it differs from execution price. |

| EP112 | Market Center Transparency | XXS | Additional party roles for (related) reporting market centers and away markets. |

| EP113 | Trading System Identification | XS | Support for identification of FIX engine and application system during logon. Note: This extension only applies to the FIX Session Layer. |

| EP114 | Security Definition and TradeSubType | XS | Reasons for the rejection of security definitions, new unit of measure for Climate Reserve Tonnes, new trade sub-type for auctions. |

| EP115 | Order Handling Extensions | XS | Addition of exchange destination information to execution notifications and cancel requests/rejects. Initial display quantity of reserve orders. |

| EP116 | Message Throttle Parameters | L | Support for throttle mechanisms that provide a method of slowing down messages, rejecting messages or disconnecting sessions above a certain rate of messages. |

| EP117 | Account Summary Reporting | M | Report with margin, settlement, collateral and pay/collect data for each clearing firm level account type. |

| EP118 | Clearing House Allocation Workflows | L | Automation of Average Pricing mechanisms, support for clearing give-ups and reversals under different allocation models (1:1, 1:n) and process models (2-party, 3-party, 4-party). |

| EP119 | Instrument Definition and Trade Prices for CDS | S | Support for uniform security definitions and price specifications of Credit Default Swaps (CDS), in particular for the OTC clearing process. |

| EP120 | SEC Short Sale Restrictions | XXS | Instrument attribute to indicate restrictions applicable to short selling of a security. |

| EP121 | SEC Short Sale Exemption Reason Code | XS | Ability to convey information regarding the reason for an exemption to short selling. |

| EP122 | Unit of Measure | S | Generalization of units of measure for currencies and a few additional units, e.g. index points. |

| EP123 | Short Sale Minimum Price | XS | Support for Short Sale Minimum Price (SSMP), including pegging of orders to SSMP. |

| EP124 | Logon | XS | Message recovery, e.g. detection of mismatching sequence numbers at logon. Note: This extension only applies to the FIX Session Layer. |

| EP125 | Order and Quote Handling | S | Mapping of orders and quotes to market data entries. Bid/offer quote identifiers. |

| EP126 | Tradeable Quotes | M | Total bid and offer sizes (quote entry versus quote modification model). Initially tradeable quotes. Quote status “traded (and removed)”. |

| EP127 | Specific Lot Allocation | S | Ability to transmit instructions identifying specific-lots for trade allocations. |

| EP128 | Risk limits | XL | Risk limit definitions, utilization monitoring and granular risk limit actions. |

| EP129 | Entitlements | XL | New messages and components to support the request for and the distribution of entitlement reference data for parties. |

| EP130 | Pre-Trade | XS | Additional reference data information for trading sessions of exchanges. Standard identification of test and dummy instruments, e.g. for business continuity testing. |

| EP131 | Order Handling | L | Multiple extensions in the area of single leg, multileg and cross order handling to cover the requirements of equity options trading in the US. |

| EP132 | US Tri-Party Repo Task Force | M | Message flows for staged orders and voiced trades; post-allocation messaging with clearing agent and investor. Support for event periods and variance of traded quantity. |

| EP133 | FIA Execution Source Code | XS | FIA execution source codes as additional order handling instructions. Support in allocation messages. |

| EP134 | Trade | XS | Price and notional value checks. Generic reject text in order/quote messages. |

| EP135 | OATS for NMS Stocks | S | Support for the expansion of OATS Rules to all NMS stocks (SR-FINRA-2010-044). |

| EP136 | Post-Trade | XS | Support for regulatory reporting in Hong Kong, e.g. one party reporting. |

| EP137 | Environment and Electrical Units of Measure | XS | Units of measure for environmental offsets and credits as well as for various electrical units beyond just MWh. Delivery times as additional events. |

| EP138 | Securities Reference Data | S | New securities reference data used to define or describe derivatives, e.g. notice dates, tick rules in spreads, negative settlement / strike price indicator. |

| EP139 | Originating Market | XXS | Inverse of an away market. |

| EP140 | Large Trader Reporting for Commodities Swaps | L | Support for CFTC rules for large trader reporting of physical commodity swaps and swaptions (76 FR 43851). |

| EP141 | Trade Reporting | XL | Support for various business processes supported by CCPs in Europe and US, for example trade splitting, trade netting, trade price conditions. Harmonization of trade reporting capabilities across execution, allocation, trade capture and position reports. |

| EP142 | Related Trades and Positions | L | Standard general mechanism for trades to identify related trades or related positions and positions to identify related trades. |

| EP143 | Quote Acknowledgements | M | New message QuoteAck(35=CW) as response to a quote submission or cancellation. |

| EP144 | Quote extensions | S | Identifiers for bid and offer side. Support for price and notional value checks. |

| EP145 | Instrument XML Definitions | XS | New components to convey an XML definition of an instrument leg or underlying instrument. |

| EP146 | Parties Reference Data Transactions | XL | New messages to support transactions on parties reference data, including entitlements. |

| EP147 | Large Trader Reporting for Commodities Swaps II | XXS | Separate unit of measure fields for settlement prices. |

| EP148 | Position Maintenance Report | XXS | Source of request for the dissemination of PositionMaintenanceReport(35=AM) messages. |

| EP149 | Order Reject Reason | XXS | Additional order reject reason related to risk management thresholds. |

| EP150 | Trade Match Report | L | New message TradeMatchReport(35=DC) for the submission of complex match events from an exchange to a clearing house in a single message. |

| EP151 | Position Quantity Types | XXS | Additional position quantity types related to exercises and assignments. |

| EP152 | Energy Units of Measure | XXS | Additional units of measure (metric volume, heat energy) for energy trading. |

| EP153 | Position Maintenance Report | XXS | Change PosMaintStatus(722) and PositionQty component from required to optional. |

| EP154 | Weight Units of Measure | XXS | Additional units of measure (gross tons, kilograms). |

| EP155 | Customer Gross Margin Reporting | XXS | Additional party roles for new account types (margin, collateral asset) and party sub ID types for PartyRole(452) = 24 (Customer Account) and 38 (Position Account). |

| EP156 | Legal Entity Identifier ISO 17442 | XXS | Additional PartyIDSource(447) for LEI codes. |

| EP157 | LSOC Reporting | XS | Support for the Legally Segregated Operationally Commingled (LSOC) Model (haircut indicator and guarantee fund for customer accounts). |

| EP158 | Security ID Source | XXS | Bloomberg Open Symbology (BBGID) as additional source for security identifiers. |

| EP159 | Multi-Dealer Quote Contribution and Negotiation | S | Support for timer concepts in fixed income trading of cash bonds. Support of multi-dealer quote environments. |

| EP160 | Security List | S | Support for Risk Based Haircut (RBH) methodology to compute capital charges. |

| EP161 | CFTC Part 43 & 45 Reporting – Credits and Rates | XXL | Support for Dodd-Frank Act’s 17 CFR Part 43 & 45 to report all swap transactions to Swap Data Repositories (SDRs) and SDRs to disseminate real-time information on swap transactions to the public. |

| EP162 | CFTC Part 39 Reporting | M | Enhancements to the AccountSummaryReport(35=CQ) and position management messages to meet CFTC Part 39 end of day reporting requirements. |

| EP163 | Market Model Typology Coverage | M | Support for the MMT standard developed by exchanges, MTF’s, market data vendors and trade reporting venues as a means of standardizing post-trade data reporting. |

| EP164 | Short Selling | XS | Enhancements in the context of amendments approved by the Canadian securities regulators to the Universal Market Integrity Rules (UMIR) regarding short sales. |

| EP165 | CDS Trade Netting, and Credit & Succession | XS | Support for swap terminations as well as credit and succession events. |

| EP166 | Stop Order Types | XXS | Support for SEC rule SR-FINRA-2012-026 relating to the handling of stop and stop limit orders. |

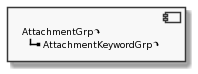

| EP167 | AttachmentGrp | S | Support for attachment of files in some binary format (PDFs, TIFFs, Microsoft Word, etc.) to FIX message, e.g. a TradeCaptureReport(35=AE) message to report bespoke deals. |

| EP168 | Spread Based Trading Negotiation | XS | Support for negotiation methods and workups in fixed income trading. |

| EP169 | CFTC Part 43 & 45 Reporting – Commodity Swaps | XXL | Support for Dodd-Frank Act’s 17 CFR Part 43 & 45 to report all swap transactions to Swap Data Repositories (SDRs) and SDRs to disseminate real-time information on swap transactions to the public. |

| EP170 | Equity Post-trade Allocations | XS | Additional reasons to reject allocations and confirmations; gross trade amount at the allocation level; mixed order capacity in confirmations. |

| EP171 | Pre-Trade Credit Limit Check | XL | Support for pre-trade clearing certainty for cleared swap transactions through all combinations of trade parties (FIA/ISDA Joint Working Group). |

| EP172 | Post-Trade Credit Limit Check | XS | Support for credit limit checks that occur post-trade. |

| EP173 | Parties Reference Data | M | Enhancement of entitlements activities between the banks (Dealers) and D2C (Dealer to Customers) execution venues. |

| EP174 | Benchmark Price Types | XXS | Support for interest rate price type and market data requests for benchmark data. |

| EP175 | Mid-Market Mark & Unique Swap Identifier | S | Enhancement to provide counterparties with pre-trade mid-market marks in the context of swaps transactions that are not cleared through a clearing house. Addition of the RegulatoryTradeIDGrp component to the ExecutionReport(35=8) message. |

| EP176 | Regulatory Transaction Type and Block Trade | XS | Support for the regulatory mandate or rule that a transaction complies with. |

| EP177 | CFTC Part 43 & 45 Gap – Addendum | XS | Minor enhancements to distinguish notional off-facility swaps and block swap trades executed on-facility and to add more clearing requirement exceptions. |

| EP178 | Batch Header | XS | Enhancement of the FIXML batch header to distinguish snapshot files from files with incremental updates. Note: This extension only applies to the FIXML encoding. |

| EP179 | European Trade Reporting | L | Support for European Market Infrastructure Regulation (EMIR), requiring clearing houses, dealers and trade participants to report all derivative transactions to Trade Repositories (TRs). Addition of party role qualifier concept. |

| EP180 | SEF Credit Limits | S | Support for credit hubs, auto acceptance and limit amount transparency. |

| EP181 | Regulatory Trade Identifiers | XS | Support for trades that must be assigned to more than one identifier. |

| EP182 | Prime Broker Credit Administration | S | Additional filter criteria for programmatical management of trading activity. |

| EP183 | Parties Reference Data | S | Support for deferred entitlement and more granular entitlement definitions. Support for attachments in the Email(35=C) message, e.g. to convey disclaimers. |

| EP184 | Quote Model Type & Quote Qualifier | M | Additional quote model (quote modification, i.e. new quote does not replace existing one), e.g. to support reserve quotes. |

| EP185 | German HFT Act | S | Support of regulatory requirements from German High Frequency Trading Act. |

| EP186 | Flagging of Automated OTC Trades | XS | Support of MMT Automated Trade Indicator. |

| EP187 | CFTC Part 43 & 45 Reporting – Foreign Exchange | XL | Support for Dodd-Frank Act’s 17 CFR Part 43 & 45 to report all swap transactions to Swap Data Repositories (SDRs) and SDRs to disseminate real-time information on swap transactions to the public. |

| EP188 | Application Layer | L | Optimizations for the application layer to support high performance interfaces. Addition of a generic identifier (OrderRequestID(2422))for order handling messages. |

| EP189 | Transfers | L | Transfer of customers’ positions from a defaulting clearing firm to the appropriate target clearing firm. |

| EP190 | Market Data | M | Various minor enhancements of the market data messages. |

| EP191 | Market Data Statistics | XL | Standardization of value added market data, especially historical data. |

| EP192 | Regulatory Trade Reporting | L | Enhancements related to collateral deposit management, reporting of collateral information, clearing and reporting of packaged swaps, linkage of identifiers and credit approval status of post-clearing allocation. |

| EP193 | Regulatory Trade Reporting Phase 2 | S | Enhancements related to collateral management, regulatory reporting to trade repositories, allocation of bunched FX trades. |

| EP194 | Pre-Trade Indication | XS | Support for relative valuation metrics and indication of a bid/ask pricing spread to a specified benchmark in the context of cash bond trading. |

| EP195 | Reference Data | L | Various extensions to the standard FIX reference data messages for parties, entitlements, risk limits, securities and market structures. |

| EP196 | Equity Post-Trade – Part 2 | S | Enhancement of the clearing submission workflow and additional granularity for fees. |

| EP197 | Collateral Management | XS | Support for multi-party collateral pledge. |

| EP198 | Indicative Execution | XS | Support for executions that arise from a match against orders or quotes requiring a confirmation, also referred to as conditional orders. |

| EP199 | Position Identifier | M | Support for a unique position identifier and additional position transaction types. |

| EP200 | Day Count Convention Description | XXS | Harmonization of the FIX naming and description of day count methods with the ISDA 2006 definitions. |

| EP201 | Trade Capture and Market Data | M | Support for voice-brokered trades and multilateral compression in trade reporting. Support for option strategies in market data distribution. |

| EP202 | Bloomberg SecurityIDSource | XXS | Change source name Bloomberg Open Symbology (BBGID) to OMG Financial Instrument Global Identifier (FIGI) security identifier. |

| EP203 | CFTC PositionReport | XS | Enhance the ability to identify the payer and receiver of swap payment streams and bullet payments. |

| EP204 | CommissionDataGrp Component | M | Support for multiple instances of commission with different types in a single message. |

| EP205 | FINRA Retail Order Identification | XXS | Additional values for CustOrderCapacity(582) related to the tick size pilot program. |

| EP206 | Timestamp Datatypes | M | Increase timestamp resolution to support ESMA requirements for MiFID II. Note: This extension only applies to the tagvalue and FIXML encodings. Binary encodings natively support explicit precision information (time units). |

| EP207 | Price Types | XXS | Specific price type for spreads in addition to existing generic type for any spread-based pricing method. |

| EP208 | CFTC Parts 43 & 45 Reporting – Equities Swaps | XXL | Support for Dodd-Frank Act’s 17 CFR Parts 43 & 45 to report all swap transactions to Swap Data Repositories (SDRs) and SDRs to disseminate real-time information on swap transactions to the public. |

| EP209 | MSRB and FINRA TRACE Reporting | XS | Enhancements for trade reporting to cover exemptions and trade price adjustments. |

| EP210 | Trade at Intermarket Sweep Order (TAISO) Price | XXS | Execution instruction to trade the order at a reference price, e.g. intermarket sweep order price. |

| EP211 | Trade Capture | XS | Support for trade compression and self-match prevention |

| EP212 | Trade Handling Instruction | XXS | Support for a trade reporting by a single but third-party relative to the trade. |

| EP213 | Party Role Qualifier | XXS | Support for a change of party or account associated with a business entity. |

| EP214 | Party Risk Limits | XS | Support for unsolicited publication of risk limit reports, risk limit status and additional risk limit types. |

| EP215 | Equity Post Trade – Part 3 | XS | Introduction of a trade confirmation identifier and ability to affirm confirmation messages. |

| EP216 | Market Model Typology v3 Support | M | Support for version 3 of the MMT standard (post-trade transparency). |

| EP217 | Trade Capture | S | Support for the reporting of complex account structures and Trade at Settlement (TAS) / Trade at Marker (TAM) spread prices. |

| EP218 | Self-Match Prevention | S | Extend self-match prevention to order handling messages (trade area). |

| EP219 | Market Maker Qualifier | XXS | Support distinction of single versus multiple market makers for a given security. |

| EP220 | Security Identifier Source | XXS | Support for Fidessa Instrument Mnemonic (FIM) as source for security identifiers. |

| EP221 | OrderQtyData component presence | XXS | Revisions to the presence attribute to remove inconsistencies. |

| EP222 | MiFID II and MiFIR Extensions Part 1 | L | Support for MiFID II and MiFIR. |

| EP223 | Order Handling | L | Various order handling extensions, including support for cross trade requests. |

| EP224 | Security Definition | XS | Explicit representation of eligibility for contrary instructions and in-the-money conditions for options. |

| EP225 | IOI Messaging to Support AFME/IA Framework | S | Common taxonomy for defining IOIs in terms of their price, underlying liquidity and, for client natural IOIs, their temporal availability. |

| EP226 | Quote Negotiation | XS | Additional quote qualifiers and use of PaymentGrp component in execution reports to support OTC derivatives. |

| EP227 | Trade Reporting | S | Support for side-specific collateral of trades, new trade types and handling instructions. |

| EP228 | MiFID II and MiFIR Extensions Part 2 | M | Support for MiFID II and MiFIR. |

| EP229 | MiFID II and MiFIR Extensions Part 3 | M | Support for MiFID II and MiFIR. |

| EP230 | Price Qualifiers | M | Information on the composition of quote prices in the fixed income trading process. |

| EP231 | MIFID II RTS 27 | L | Enhancement of value added market data for MiFID II. |

| EP232 | ESMA RTS 22 Transaction Reporting | S | Support for additional personal data, order transmitters, and full instrument names. |

| EP233 | MiFID II Equity Post Trade Commission Unbundling | XS | Additional commission (sub)types to support payment for research (CSA and RPA). |

| EP234 | Allocations of Multileg Order/Trade | XS | Identification of the leg of a multileg order or trade. |

| EP235 | ESMA RTS 2 and RTS 23 Reference Data | L | Support for reporting of securities reference data under MiFID II. |

| EP236 | MiFID II RTS 28 | M | Enhancement of value added market data for MiFID II. |

| EP237 | MiFID II and MiFIR Extensions Part 4 | M | Support for MiFID II and MiFIR. |

| EP238 | ESMA RTS 2 Segmentation Criteria and Extensions to Option Type and Swap Subtype | M | Support for liquidity assessment, LIS and SSTI thresholds required by ESMA. |

| EP239 | Allocation Instruction Alert Request | S | Support for group allocations and concept of Notional Value Average Price (NVAP). |

| EP240 | Average Pricing and Markup | S | Enhancements to support trade submission and give-up by clients of a Central Counterparty (CCP) clearing house. |

| EP241 | Average Pricing | S | Enhancements to assist trade give-up by clients of a Central Counterparty (CCP) clearing house. |

| EP242 | UMTF Symbology | XXS | Support new security identifier scheme UMTF (Uniform Multilateral Trading Facility). |

| EP243 | Unit of Measure and Trade Sub Type | XXS | Support heat rates for energy commodity trades and Trade At Cash Open (TACO) trading. |

| EP244 | India NSE PAN ID | XXS | Support India permanent account number (PAN) as additional source for party identifiers. |

| EP245 | Automatic Claim Handling | XS | Enhance allocation handling instructions for clearing firms to cover give-up to oneself. |

| EP246 | Confirmation | M | Support third-party facility providing the confirmation matching function between the dealer and the investment manager. |

| EP247 | FX Trade Aggregation | M | Support for trade aggregation, e.g. for FX trading between buy-side institutions and sell-side FX banks |

| EP248 | FDID (Firm Designated Identifier) | XXS | Unique identifier for each trading account required by US SEC Rule 613 (CAT NMS Plan) |

| EP249 | Post Post-trade Confirmation Payments | XL | Support for for reconciliation and agreement of cash movement activities between an Investment Manager and its Broker. |

| EP250 | Share Trading Obligation | XXS | Support for differences in UK share trading obligations due to Brexit. |

| EP251 | Recording consent to facilitate trades | XXS | Explicit consent for client facilitation activities required by the Hong Kong SFC (Securities and Futures Commission). |

| EP252 | Liquidity Indicator | XXS | Additional liquidity indicators for neutrality and for orders requiring a confirmation. |

| EP253 | CAT/FIX Mapping Phase 2A | M | Support for data reporting required by the CAT (Consolidated Audit Trail) NMS Plan. |

| EP254 | EU SFTR Reporting | XL | Support for EU Securities Financing Transactions (SFT) Reporting (SFTR regulations). |

| EP255 | STO Exemption | XXS | Support for exemptions from share trading obligations on the order level. |

| EP256 | IIROC Client Identification | S | Support for IIROC Rules Notice 19-0071 – Amendments Respecting Client Identifiers. |

| EP257 | Targeted Trade Advertisements | XS | Support to target or block firms from trade advertisements. |

| EP258 | Bilateral Repo Trade and Post-Trade | S | Support for trade and post-trade workflows for bilateral repo transactions. |

| EP259 | Related Orders | M | Support for order aggregation on execution reports. |

| EP260 | Application Version for FIX Latest | XS | Application version identifier for FIX Latest. |

| EP261 | RegulatoryReportType Extension | XS | Additional support for CAT (Consolidated Audit Trail) event types. |

| EP262 | APAC Master SPSA | XXS | Additional sources for parties to support segregated accounts in the APAC region. |

| EP263 | Regulatory Timestamps for Quotes | XS | Support for repeating group of timestamps in quote messages. |

| EP264 | CAT/FIX Mapping Phase 2 – Update | S | Additional support for data reporting required by CAT (Consolidated Audit Trail). |

| EP265 | Previous Quote Identifier | XS | Support for related quotes in the Quote(35=S) message. |

| EP266 | Extension for Unique Product Identifier | S | Support for the UPI standard (ISO-4914). |

| EP267 | Market Data Extensions | S | Additional market data entry types, e.g. to support TWAP and financing rates. |

| EP268 | Market Model Typology v3.5 Support | M | Support for version 3.5 of the MMT standard (post-trade transparency). |

| EP269 | Trade Compression Extension | XS | Support distinction between bilateral and multilateral compression. |

| EP270 | BeginString and FIX Latest | S | Adding values to BeginString(8) to support FIX Latest over legacy FIX Session Protocols. |

| EP271 | Errors and Omissions 2021 | M | Correction of errors and omissions in the FIX Protocol. |

| EP272 | Code set extensions 2021 | S | Additional values for selected fields, e.g. SecurityType(167). |

| EP273 | Extensions for Digital Asset Trading | L | Standardization of trading for digital assets including cryptocurrencies. |

| EP274 | Anonymous Trade Indicator Extension | XS | Support for regulatory requirement related to trade reporting of swaps into an SDR. |

| EP275 | RegulatoryTradeIDGrp Enhancements | S | Support for regulatory requirement related to the use of USI and UTI in transaction reporting. |

| EP276 | Security Reference Data Extensions | XS | Supplemental field to uniquely identify an instrument. |

| EP277 | Market Model Typology v4.0 Support | M | Support for version 4.0 of the MMT standard (post-trade transparency). |

| EP278 | Liquidity Indicator Extension | XS | Clarification of LastLiquidityInd(851)=0 (Neither added nor removed liquidity) by addition of new values (“Unknown” and “Other”). |

| EP279 | Clearing Enhancements | S | Support for initial broker owning a trade and addition of TrdMatchID(880) to the allocation and confirmation messages. |

| EP280 | Self-Match Prevention Instruction | S | Support for the order submitter to indicate a self-match prevention (SMP) instruction. |

| EP281 | Settlement Status Management | L | Communication of settlement status between investment managers and brokers, custodians or an outsource (vendor system). |

| EP282 | Errors and Omissions 2022 | M | Correction of errors and omissions in the FIX Protocol. |

| EP283 | Post-Trade Transparency for UK Equities | S | Support for post-trade transparency flags CLSE (trade at market closing price) and NETW (negotiated transaction) issued by the FCA. |

| EP284 | EMIR Report Tracking Number (RTN) | XS | Support for regulatory identifier (predecessor was Transaction Reference Number (TRN)). |

FIX Protocol datatypes

FIX supports a number of different ASCII and binary encodings. This section only describes the definitions and value spaces of datatypes. They are shared among all FIX message encodings. The value space of a datatype is defined using the vocabulary of ISO/IEC 11404:2007 Information technology – General-Purpose Datatypes (GPD). The mapping of datatypes to a wire format, i.e. their lexical space (a.k.a. “syntax”), depends on the chosen encoding and is defined in the encoding’s respective Technical Standard specification. See the Introduction for a list of FIX encodings.

Note that some of the binary encodings (e.g. SBE) allow the usage of a more efficient value space as long as its values are a subset of the given datatype. For example, String fields may be limited to whole numbers in case of entity identifiers by using an int datatype instead. An int field, however, must never be changed to a String field as this would allow additional values not covered by the value space of the datatype int.

Datatype definitions and value spaces

| Datatype | Definition | Value space (ISO/IEC 11404:2007) |

|---|---|---|

| int | Integer number. | integer |

| TagNum | A field’s tag number. | ordinal |

| SeqNum | A message sequence number. | ordinal |

| NumInGroup | The number of entries in a repeating group. | size |

| DayOfMonth | Day number within a month (values 1 to 31) | integer range 1..31 |

| float | All float fields must accommodate up to fifteen significant digits. The number of decimal places used should be a factor of business/market needs and mutual agreement between counterparties. | real |

| Qty | Either a whole number (no decimal places) of “shares” (securities denominated in whole units) or a decimal value containing decimal places for non-share quantity asset classes (securities denominated in fractional units). | Scaled

radix=10 |

| Price | A price. Note the number of decimal places may vary. For certain asset classes prices may be negative values. For example, prices for options strategies can be negative under certain market conditions. | Scaled

radix=10 |

| PriceOffset | A price offset, which can be mathematically added to a Price. Note the number of decimal places may vary and some fields such as LastForwardPoints may be negative. | Scaled

radix=10 |

| Amt | Typically representing a Price times a Qty. | Scaled

radix=10 |

| Percentage | A percentage (e.g. 0.05 represents 5% and 0.9525 represents 95.25%). Note the number of decimal places may vary. | real |

| char | A single character. All char fields are case sensitive (i.e. m != M). | character

repertoire=8859-1 (Latin-1)1 |

| Boolean | Boolean. | boolean |

| String | Text. All String fields are case sensitive (i.e., “morstatt” != “Morstatt”). | characterstring

repertoire=8859-1 (Latin-1)2 |

| MultipleCharValue3 | Set of character codes. | set element=character

repertoire=8859-1 (Latin-1)4 |

| MultipleStringValue5 | Set of string codes. | set element=character string

repertoire=8859-1 (Latin-1)6 |

| Country | External code set ISO 3166-1:2013 Codes for the representation of names of countries and their subdivisions – Part 1: Country codes. | array element=character index-lowerbound=1 index-upperbound=2 |

| Currency | External code set ISO 4217:2015 Codes for the representation of currencies and funds. | array element=character index-lowerbound=1 index-upperbound=3 |

| Exchange | External code set ISO 10383:2012 Securities and related financial instruments – Codes for exchanges and market identification (MIC). | array element=character index-lowerbound=1 index-upperbound=4 |

| MonthYear | Month and year of instrument maturity or expiration. | characterstring |

| UTCTimestamp | UTC date/time. | time

time-unit=millisecond or up to picosecond by bilateral agreement |

| UTCTimeOnly | UTC time of day. | time

time-unit=millisecond or up to picosecond by bilateral agreement |

| UTCDateOnly | UTC date. | time

time-unit=day |

| LocalMktDate | Local date. | time

time-unit=day |

| TZTimeOnly | Time of day with timezone | time

time-unit=millisecond or up to picosecond by bilateral agreement |

| TZTimestamp | Date/time with timezone. | time

time-unit=millisecond or up to picosecond by bilateral agreement |

| Length7 | Length of a data field in octets. | size |

| data8 | Opaque data or variable-length string. | A union of two datatypes: octetstring and characterstring repertoire=(value encoded using the encoding specified in the MessageEncoding(347) field) |

| Tenor | Time duration composed of a time unit (day, week, month, year) and a quantity in that time unit. | characterstring

Dx = tenor expression for “days”, e.g. “D5”, where “x” is any integer > 0 Mx = tenor expression for “months”, e.g. “M3”, where “x” is any integer > 0 Wx = tenor expression for “weeks”, e.g. “W13”, where “x” is any integer > 0 Yx = tenor expression for “years”, e.g. “Y1”, where “x” is any integer > 0 |

| Reserved100Plus | Values 100 and above are reserved for bilaterally agreed upon user defined enumerations. | integer range minInclusive=100 |

| Reserved1000Plus | Values 1000 and above are reserved for bilaterally agreed upon user defined enumerations. | integer range minInclusive=1000 |

| Reserved4000Plus | Values 4000 and above are reserved for bilaterally agreed upon user defined enumerations. | integer range minInclusive=4000 |

| XMLData | XML document. | characterstring

repertoire=(value of XML encoding declaration) |

| Language | External code set ISO 639-1:2002 Codes for the representation of names of languages – Part 1: Alpha-2 code. | array element=character index-lowerbound=1 index-upperbound=2 |

| LocalMktTime | Time local to a market center. | time

time-unit=second |

UTC and leap seconds

Note that UTC includes corrections for leap seconds, which are inserted to account for slowing of the rotation of the earth. Leap second insertion is declared by the International Earth Rotation Service (IERS) and has, since 1972, only occurred on the night of December 31 or June 30. The IERS considers March 31 and September 30 as secondary dates for leap second insertion but has never utilized these dates. During a leap second insertion, a UTCTimestamp field in tagvalue encoding may read “19981231-23:59:59”, “19981231-23:59:60”, “19990101-00:00:00” (see https://maia.usno.navy.mil/information/what-is-a-leap-second).

Global Components

Introduction

Global components are components that are used in two or more business areas, e.g. pre-trade and trade. With the objective of re-using components rather than creating new ones, existing components may become global due to a new FIX Extension Pack. This section not only shows the global components but also those that are currently common only within a single business area and conceptually identical to a global component.

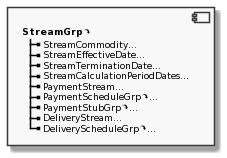

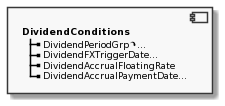

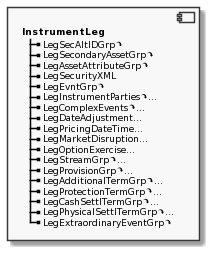

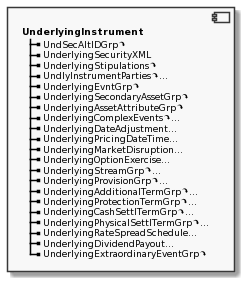

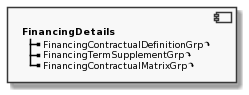

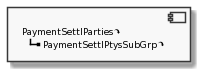

The following sections are grouped by entities, e.g. instruments, parties, etc. The descriptions for the components are provided by component names’ alphabetical order within their group. In addition to the descriptive text, a given component is visualized with a diagram whenever it has one or more nested components. Only the first level of nesting is shown and “…” indicates more deeply nested components. The descriptions of the nested components of the first (or previous) level then contain a diagram with the next level of components nested within it.

Global Components for Securities

Some of the global components for an instrument (Instrument), its legs (InstrumentLeg), and its underlying instrument (UnderlyingInstrument) are conceptually identical. The descriptions for these conceptually identical global components are only provided once at the instrument level unless it is a component that is only present at the leg or underlying instrument level. The following table lists such global components whereby the links for all components go to the description of the instrument level component. Additional links at the end of the description go to the component layout.

Additional contract terms

AdditionalTermBondRefGrp

This component is a repeating group that is part of the AdditionalTermGrp component and used to identify an underlying reference bond for a swap. The component layouts are available here: AdditionalTermBondRefGrp, LegAdditionalTermBondRefGrp, UnderlyingAdditionalTermBondRefGrp.

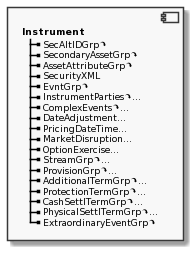

AdditionalTermGrp

This component is a repeating group that is part of the Instrument component and used to report additional contract terms. The component layouts are available here: AdditionalTermGrp, LegAdditionalTermGrp, UnderlyingAdditionalTermGrp.

Assets

AssetAttributeGrp

This component is a repeating group that is part of the Instrument component and is used to detail attributes of the instrument asset. The component layouts are available here: AssetAttributeGrp, LegAssetAttributeGrp, UnderlyingAssetAttributeGrp.

SecondaryAssetGrp

This component is a repeating group that is part of the Instrument component. It is used to specify secondary assets of a multi-asset swap. The component layouts are available here: SecondaryAssetGrp, LegSecondaryAssetGrp, UnderlyingSecondaryAssetGrp.

Cash Settlement Terms

This section describes global components related to cash settlement terms of an instrument. The components are listed in alphabetical order with the exception of the main (root) component.

Overview

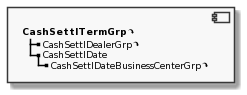

CashSettlTermGrp

This component is a repeating group that is part of the Instrument component. It is used to report cash settlement terms referenced from underlying instruments.

Usage of CashSettlTermGrp must either include a known CashSettlAmount(40034) or provide the cash settlement term parameters needed to derive the cash settlement amount. CashSettlTermXID(40039) is provided for cross-referencing from an instance of the UnderlyingInstrument component through the UnderlyingSettlTermXIDRef(41315) field.

The component layouts are available here: CashSettlTermGrp, LegCashSettlTermGrp, UnderlyingCashSettlTermGrp.

CashSettlDate

This component is part of the CashSettlTermGrp component. It is used to report the cash settlement date defined in the settlement provision. The component layouts are available here: CashSettlDate, LegCashSettlDate, UnderlyingCashSettlDate.

CashSettlDateBusinessCenterGrp

This component is a repeating group that is part of the CashSettlDate component and conceptually identical to the BusinessCenterGrp component. It is used to specify the set of business centers whose calendars drive the date adjustment. Used only to override the business centers defined in the DateAdjustment component within the Instrument component. The component layouts are available here: CashSettlDateBusinessCenterGrp, LegCashSettlDateBusinessCenterGrp, UnderlyingCashSettlDateBusinessCenterGrp.

CashSettlDealerGrp

This component is a repeating group that is part of the CashSettlTermGrp component. It is used to specify the dealers from whom price quotations for the reference obligation are obtained for the purpose of cash settlement valuation. The component layouts are available here: CashSettlDealerGrp, LegCashSettlDealerGrp, UnderlyingCashSettlDealerGrp.

Complex Events

This section describes global components related to complex events of an instrument. The components are listed in alphabetical order with the exception of the main (root) component.

Overview

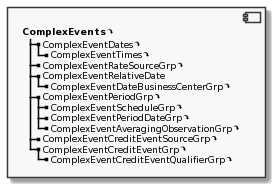

ComplexEvents

This component is a repeating group that is part of the Instrument component. It allows specifying an unlimited number and types of advanced events, such as observation and pricing over the lifetime of an option, futures, commodities or equity swap contract. Use the EvntGrp to specify more straightforward events. The component layouts are available here: ComplexEvents, LegComplexEvents, UnderlyingComplexEvents.

ComplexEventAveragingObservationGrp

This component is a repeating group that is part of the ComplexEventPeriodGrp component. It is used for specifying the weight of each of the dated observations. The component layouts are available here: ComplexEventAveragingObservationGrp, LegComplexEventAveragingObservationGrp, UnderlyingComplexEventAveragingObservationGrp.

ComplexEventCreditEventGrp

This component is a repeating group that is part of the ComplexEvents component. It is used to report applicable option credit events. The component layouts are available here: ComplexEventCreditEventGrp, LegComplexEventCreditEventGrp, UnderlyingComplexEventCreditEventGrp.

ComplexEventCreditEventQualifierGrp

This component is a repeating group that is part of the ComplexEventCreditEventGrp component. It is used to specify qualifying attributes to an event. The component layouts are available here: ComplexEventCreditEventQualifierGrp, LegComplexEventCreditEventQualifierGrp, UnderlyingComplexEventCreditEventQualifierGrp.

ComplexEventCreditEventSourceGrp

This component is a repeating group that is part of the ComplexEvents component. It is used to specify the particular newspapers or electronic news services that may publish relevant information used in the determination of whether or not a credit event has occurred. The component layouts are available here: ComplexEventCreditEventSourceGrp, LegComplexEventCreditEventSourceGrp, UnderlyingComplexEventCreditEventSourceGrp.

ComplexEventDateBusinessCenterGrp

This component is a repeating group that is part of the ComplexEventRelativeDate component and conceptually identical to the BusinessCenterGrp component. It is used to specify the set of business centers whose calendars drive date adjustment. Used only to override the business centers defined in the DateAdjustment component in the Instrument component. The component layouts are available here: ComplexEventDateBusinessCenterGrp, LegComplexEventDateBusinessCenterGrp, UnderlyingComplexEventDateBusinessCenterGrp.

ComplexEventDates

This component is a repeating group that is part of the ComplexEvents component. It is used to constrain a complex event to a specific date range or time range. If specified the event is only effective on or within the specified dates and times. The component layouts are available here: ComplexEventDates, LegComplexEventDates, UnderlyingComplexEventDates.

ComplexEventPeriodDateGrp

This component is a repeating group that is part of the ComplexEventPeriodGrp component. It is used for specifying fixed period dates and times for complex or exotic options, such as an Asian or Strike Schedule option or trigger dates for a Barrier or Knock option. The component layouts are available here: ComplexEventPeriodDateGrp, LegComplexEventPeriodDateGrp, UnderlyingComplexEventPeriodDateGrp.

ComplexEventPeriodGrp

This component is a repeating group that is part of the ComplexEvents component. It is used for specifying the periods or schedules for Asian, Barrier, Knock or Strike Schedule option features. The component layouts are available here: ComplexEventPeriodGrp, LegComplexEventPeriodGrp, UnderlyingComplexEventPeriodGrp.

ComplexEventRateSourceGrp

This component is a repeating group that is part of the ComplexEvents component. It is used for specifying primary and secondary rate sources. The component layouts are available here: ComplexEventRateSourceGrp, LegComplexEventRateSourceGrp, UnderlyingComplexEventRateSourceGrp.

ComplexEventRelativeDate

This component is part of the ComplexEvents component. It is used for specifying the event date and time for an FX or Calendar Spread option or the payout date for a Barrier or Knock option. The component layouts are available here: ComplexEventRelativeDate, LegComplexEventRelativeDate, UnderlyingComplexEventRelativeDate.

ComplexEventScheduleGrp

This component is a repeating group that is part of the ComplexEventPeriodGrp component. It is used for specifying a periodic schedule for an Asian, Barrier or Strike Schedule option feature. The component layouts are available here: ComplexEventScheduleGrp, LegComplexEventScheduleGrp, UnderlyingComplexEventScheduleGrp.

ComplexEventTimes

This component is a repeating group that is part of the ComplexEventDates component. It is used to further qualify any dates placed on the event and is used to specify time ranges for which a complex event is effective. It is always provided within the context of start and end dates. The time range is assumed to be in effect for the entirety of the date or date range specified. The component layouts are available here: ComplexEventTimes, LegComplexEventTimes, UnderlyingComplexEventTimes.

Date adjustments

The following table links directly to the layout of all related components available to specify the set of business centers whose calendars drive the date adjustment. They may be used to override the information from BusinessCenterGrp defined in this section.

BusinessCenterGrp

This component is a repeating group that is part of the DateAdjustment component. It is the primary component used to specify the set of business centers whose calendars drive the date adjustment. The business centers defined here apply to all adjustable dates in the instrument unless specifically overridden in the respective specified components elsewhere. The component layouts are available here: BusinessCenterGrp, LegBusinessCenterGrp, UnderlyingBusinessCenterGrp.

DateAdjustment

This component is part of the Instrument component. It is the primary component used to specify date adjustment parameters and rules. The date adjustments specified here applies to all adjustable dates for the instrument, unless specifically overridden in the respective specified components elsewhere. The component layouts are available here: DateAdjustment, LegDateAdjustment, UnderlyingDateAdjustment.

Events

EvntGrp

This component is a repeating group that is part of the Instrument component and used to specify straightforward events associated with the instrument. Examples include put and call dates for bonds and options; first exercise date for options; inventory and delivery dates for commodities; start, end and roll dates for swaps. Use the ComplexEvents component for more advanced dates and events such as option, futures, commodities and equity swap observation and pricing events.

The EvntGrp component contains three different methods to express a “time” associated with the event using the EventDate(866) and EventTime(1145) pair of fields or the EventTimeUnit(1827) and EventTimePeriod(1826) pair of fields or EventMonthYear(2340). When this component is used one of these three time expression methods must be specified.

The EventDate(866), and optional EventTime(1145), may be used to specify an exact date and optional time for the event. The EventTimeUnit(1827) and EventTimePeriod(1826) may be used to express a time period associated with the event, e.g. 3-month, 4-years, 2-weeks. The EventMonthYear(2340), and optional EventTime(1145), may be used to express the event as a month of year, with optional day of month or week of month.

The component layouts are available here: EvntGrp, LegEvntGrp, UnderlyingEvntGrp.

ExtraordinaryEventGrp

This component is a repeating group that is part of the Instrument component. It is used to report extraordinary and disruptive events applicable to the reference entity that affects the contract. The component layouts are available here: ExtraordinaryEventGrp, LegExtraordinaryEventGrp, UnderlyingExtraordinaryEventGrp.

InstrmtGrp

This component is a repeating group that allows one or more securities to be conveyed. The component layout is available here.

Instrument

This component is used as part of many messages as well as repeating groups and contains all the fields commonly used to describe a security or instrument. Typically, the data elements in this component block are considered the static data of a security, data that may be commonly found in a security master database. The Instrument component may be used to describe any asset type supported by FIX. The component layout is available here.

Instrument Extensions

InstrumentExtension

This component identifies additional security attributes that are more commonly found for fixed income securities. The component layout is available here.

AttrbGrp

This component is a repeating group that is part of InstrumentExtension component and contains additional attributes of a security related to fixed income. The component layout is available here.

FloatingRateIndex

This component is part of the InstrumentExtension component and may be used to identify the rate index for a floating rate coupon.

In the context of MiFID II RTS 23 Annex I Table 3 reference data, this is used as statement of the attributes of the index/benchmark of a floating rate security. The component layout is available here.

IndexRollMonthGrp

This component is a repeating group that is part of the InstrumentExtension component and may be used to specify multiple roll months in a given year for an index.

In the context of MiFID II RTS 2 Annex IV Table 2 reference data, this is used to specify all months when the roll is expected as established by the CDS index provider for a given year – repeated for each month in the roll. The component layout is available here.

ReferenceDataDateGrp

This component is a repeating group that is part of the InstrumentExtension component and may be used to carry the different dates (and timestamps) related to the reference data entry.

In the context of MiFID II RTS 23 Annex I Table 3 reference data, this is used as statement of the attributes of the index/benchmark of a floating rate security. The component layout is available here.

Instrument Identifier

RelatedInstrumentGrp

This component is a repeating group that is at the same hierarchical level as the Instrument component, describing relationships and linkages between the security, leg security and underlying security entries. If all instances of the UnderlyingInstrument component in the message are true underliers of the Instrument component, then the RelatedInstrumentGrp component is not needed. If any instance of the UnderlyingInstrument component has a different relationship, e.g. underlier of an instance of the InstrumentLeg component, stream, equity equivalent or nearest exchange-traded contract or if there are multiple instances of the InstrumentLeg component, then an entry for every relationship should be included in this component. When the RelatedInstrumentGrp component appears within a repeating group, each entry only applies to the Instrument component at the same hierarchical level.

In messages such as Email(35=C) and News(35=B), where the Instrument and the InstrumentLeg component are within their repeating groups, the RelatedInstrumentGrp component may be used to link legs and underliers to their appropriate base security.

For simple relationships such as identifying a “hedges for” security, the entry simply defines the symbol or identifier of an externally known security. For relationships within strategies and swaps, the entry refers up through one of the “related to” fields to the security, leg security, underlying security, stream or dividend period with which the related security has correlation. It then points down through RelatedSecurityID(1650) or RelatedSymbol(1649) to an UnderlyingInstrument instance in the current message defining the related security. The nature of the relationship is given in RelatedInstrumentType(1648).

The component layout is available here.

SecAltIDGrp

This component is a repeating group that is part of the Instrument component. It is used to provide alternate identifiers for a given security. The component layouts are available here: SecAltIDGrp, LegSecAltIDGrp, UndSecAltIDGrp.

SecurityXML

This component is used to provide a definition in an XML format for the instrument. The component layouts are available here: SecurityXML, LegSecurityXML, UnderlyingSecurityXML.

Instrument Parties

InstrumentParties

This component is a repeating group that is conceptually identical to the Parties component. It is used to identify the party(-ies) that are part of the instrument’s reference data (e.g. the issuer) within the context of the instrument component it appears in. It is not permitted to use this component to contain transactional information (i.e. parties in the transaction). Only a specified subset of party roles will be supported within the InstrumentParties component. The component layouts are available here: InstrumentParties, LegInstrumentParties, UndlyInstrumentParties.

InstrumentPtysSubGrp

This component is a repeating group that is part of the InstrumentParties component and conceptually identical to the PtysSubGrp component. It is used to provide additional or supplemental information related to the instance of the party identifier it is attached to. The component layouts are available here: InstrumentPtysSubGrp, LegInstrumentPtysSubGrp, UndlyInstrumentPtysSubGrp.

Market Disruptions

MarketDisruption

This component is part of the Instrument component and used to specify the market disruption provisions of the swap. The component layouts are available here: MarketDisruption, LegMarketDisruption, UnderlyingMarketDisruption.

MarketDisruptionEventGrp

This component is a repeating group that is part of the MarketDisruption component and used to specify the market disruption events. The component layouts are available here: MarketDisruptionEventGrp, LegMarketDisruptionEventGrp, UnderlyingMarketDisruptionEventGrp.

MarketDisruptionFallbackGrp

This component is a repeating group that is part of the MarketDisruption component and used to specify the market disruption fallback provisions. The component layouts are available here: MarketDisruptionFallbackGrp, LegMarketDisruptionFallbackGrp, UnderlyingMarketDisruptionFallbackGrp.

MarketDisruptionFallbackReferencePriceGrp

This component is a repeating group that is part of the MarketDisruption component and used to specify fallback reference price and underlying security provisions. The component layouts are available here: MarketDisruptionFallbackReferencePriceGrp, LegMarketDisruptionFallbackReferencePriceGrp, UnderlyingMarketDisruptionFallbackReferencePriceGrp.

Option Exercise Provisions

This section describes global components related to option exercise provisions of an instrument. The components are listed in alphabetical order with the exception of the main (root) component.

Overview

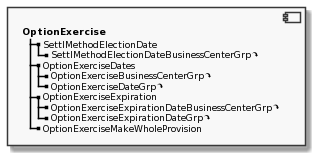

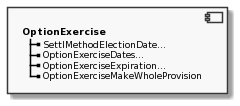

OptionExercise

This component is part of the Instrument component and used to specify option exercise provisions. Its purpose is to identify the opportunities and conditions for exercise, e.g. the schedule of dates on which exercise is allowed. The embedded OptionExerciseExpiration component is used to terminate the opportunity for exercise. The component layouts are available here: OptionExercise, LegOptionExercise, UnderlyingOptionExercise.

OptionExerciseBusinessCenterGrp

This component is a repeating group that is part of the OptionExerciseDates component. It is used to specify the set of business centers whose calendars drive date adjustment. Used only to override the business centers defined in the DateAdjustment component in the Instrument component. The component layouts are available here: OptionExerciseBusinessCenterGrp, LegOptionExerciseBusinessCenterGrp, UnderlyingOptionExerciseBusinessCenterGrp.

OptionExerciseDateGrp

This component is a repeating group that is part of the OptionExerciseDates component. It is used to specify fixed dates for exercise. The component layouts are available here: OptionExerciseDateGrp, LegOptionExerciseDateGrp, UnderlyingOptionExerciseDateGrp.

OptionExerciseDates

This component is part of the OptionExercise component. It is used to specify option exercise dates. The component layouts are available here: OptionExerciseDates, LegOptionExerciseDates, UnderlyingOptionExerciseDates.

OptionExerciseExpiration

This component is part of the OptionExercise component. It is used to specify option exercise expiration dates and times. The purpose of OptionExerciseDates is to identify the scheduled opportunities for exercise. The OptionExerciseExpiration component identifies the end of the schedule. The component layouts are available here: OptionExerciseExpiration, LegOptionExerciseExpiration, UnderlyingOptionExerciseExpiration.

OptionExerciseExpirationDateGrp

This component is a repeating group that is part of the OptionExerciseExpiration component. It is used to specify fixed dates for expiration. The component layouts are available here: OptionExerciseExpirationDateGrp, LegOptionExerciseExpirationDateGrp, UnderlyingOptionExerciseExpirationDateGrp.

OptionExerciseExpirationDateBusinessCenterGrp

This component is a repeating group that is part of the OptionExerciseExpiration component. It is used to specify the set of business centers whose calendars drive date adjustment. Used only to override the business centers defined in the DateAdjustment component in the Instrument component. The component layouts are available here: OptionExerciseExpirationDateBusinessCenterGrp, LegOptionExerciseExpirationDateBusinessCenterGrp, UnderlyingOptionExerciseExpirationDateBusinessCenterGrp.

OptionExerciseMakeWholeProvision

This component is part of the OptionExercise component. It is used to specify the set of rules of maintaining balance when an option is exercised. A “make whole” provision seeks to penalize the option buyer, i.e. make the seller “whole”, if the buyer exercises the option prior to the make whole date, e.g. the early call date of a convertible bond. The component layouts are available here: OptionExerciseMakeWholeProvision, LegOptionExerciseMakeWholeProvision, UnderlyingOptionExerciseMakeWholeProvision.

SettlMethodElectionDate

This component is part of the OptionExercise component. It is used to report the settlement method election date. The component layouts are available here: SettlMethodElectionDate, LegSettlMethodElectionDate, UnderlyingSettlMethodElectionDate.

SettlMethodElectionDateBusinessCenterGrp

This component is a repeating group that is part of the SettlMethodElectionDate component. It is used to specify the set of business centers whose calendars drive the date adjustment. Used only to override the business centers defined in the DateAdjustment component in the Instrument component. The component layouts are available here: SettlMethodElectionDateBusinessCenterGrp, LegSettlMethodElectionDateBusinessCenterGrp, UnderlyingSettlMethodElectionDateBusinessCenterGrp.

Physical Settlement Terms

PhysicalSettlDeliverableObligationGrp

This component is a repeating group that is part of the PhysicalSettlTermGrp component. It is used to report CDS physical settlement delivery obligations. The component layouts are available here: PhysicalSettlDeliverableObligationGrp, LegPhysicalSettlDeliverableObligationGrp, UnderlyingPhysicalSettlDeliverableObligationGrp.

PhysicalSettlTermGrp

This component is a repeating group that is part of the Instrument component. It is used to report physical settlement terms referenced from underlying instruments.

PhysicalSettlTermXID(40208) is provided for cross-referencing from an instance of the UnderlyingInstrument component through the UnderlyingSettlTermXIDRef(41315) field. The component layouts are available here: PhysicalSettlTermGrp, LegPhysicalSettlTermGrp, UnderlyingPhysicalSettlTermGrp.

Pricing Dates and Times

PricingDateBusinessCenterGrp

This component is a repeating group that is part of the PricingDateTime component. It is used to specify the set of business centers whose calendars drive date adjustment. Used only to override the business centers defined in the DateAdjustment component in the Instrument component. The component layouts are available here: PricingDateBusinessCenterGrp, LegPricingDateBusinessCenterGrp, UnderlyingPricingDateBusinessCenterGrp.

PricingDateTime

This component is part of the Instrument component. It is used to specify an adjusted or unadjusted pricing or fixing date and optionally the time, e.g. for a commodity or FX forward trade. The component layouts are available here: PricingDateTime, LegPricingDateTime, UnderlyingPricingDateTime.

Protection Terms

ProtectionTermGrp

This component is a repeating group that is part of the Instrument component. It is used to report protection term details referenced from underlying instruments.

ProtectionTermXID(40190) is provided for cross-referencing from an instance of the UnderlyingInstrument component through the UnderlyingProtectionXIDRef(41314) field. The component layouts are available here: ProtectionTermGrp, LegProtectionTermGrp, UnderlyingProtectionTermGrp.

ProtectionTermEventGrp

This component is a repeating group that is part of the ProtectionTermGrp component. It is used to report applicable credit events for a Credit Default Swap (CDS). The component layouts are available here: ProtectionTermEventGrp, LegProtectionTermEventGrp, UnderlyingProtectionTermEventGrp.

ProtectionTermEventNewsSourceGrp

This component is a repeating group that is part of the ProtectionTermGrp component. It is used to specify the particular newspapers or electronic news services and sources that may publish relevant information used in the determination of whether or not a credit event has occurred. The component layouts are available here: ProtectionTermEventNewsSourceGrp, LegProtectionTermEventNewsSourceGrp, UnderlyingProtectionTermEventNewsSourceGrp.

ProtectionTermEventQualifierGrp

This component is a repeating group that is part of the ProtectionTermEventGrp component. It is used to specify qualifying attributes to the event. The component layouts are available here: ProtectionTermEventQualifierGrp, LegProtectionTermEventQualifierGrp, UnderlyingProtectionTermEventQualifierGrp.

ProtectionTermObligationGrp

This component is a repeating group that is part of the ProtectionTermGrp component. It is used to report applicable CDS obligations. The component layouts are available here: ProtectionTermObligationGrp, LegProtectionTermObligationGrp, UnderlyingProtectionTermObligationGrp.

Provisions

This section describes global components related to additional terms, provisions and conditions associated with an instrument. The components are listed in alphabetical order with the exception of the main (root) component.

Overview

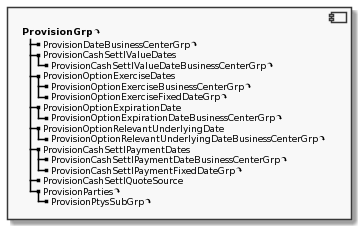

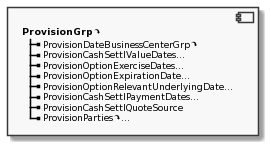

ProvisionGrp

This component is a repeating group that is part of the Instrument component. It is used to detail additional terms, provisions and conditions associated with the instrument. A swap may have one or more provisions defined. The component layouts are available here: ProvisionGrp, LegProvisionGrp, UnderlyingProvisionGrp.

ProvisionCashSettlPaymentDateBusinessCenterGrp